The Meltdown in Global Crude Oil prices …

15th November 2015

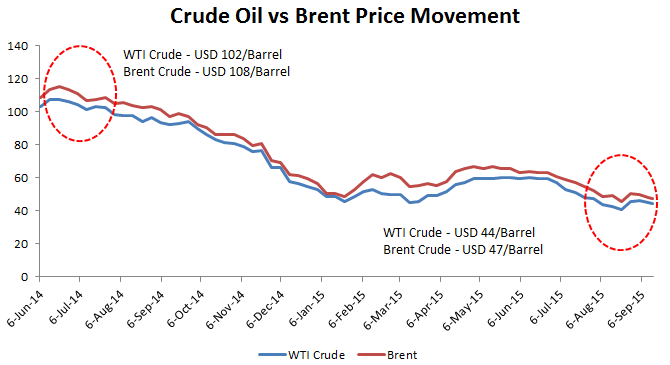

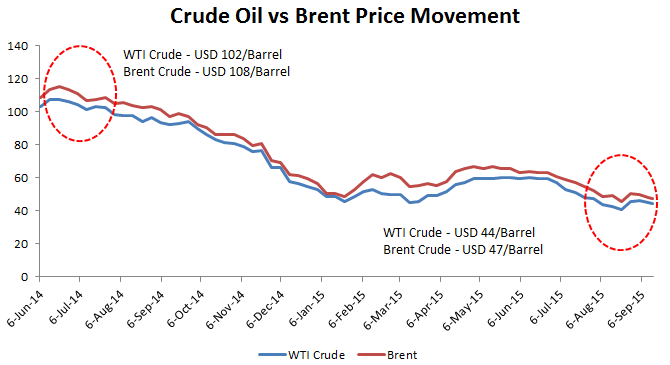

- Crude Oil has almost halved its value since June 2014. As of 15 September 2015, crude oil ended trading at $44.59/barrel, whilst Brent closed at $46.63/barrel on account of global oversupply concerns, a slowdown in the global economy and geo-political uncertainty.

- To put things in perspective, crude oil has more than halved its market value since reaching a level of $102/barrel in June 2014. The key contributing factor to this has been unwillingness from major oil producing cartel such as the OPEC to curb oil production despite a steep decline in prices. This is because oil producers want to maintain their market share, and drive out competition from US shale producers which have capital-intensive operations. The impact of this can be seen in budget deficits in major Middle East economies such as Saudi Arabia, because their economies are highly dependent on oil revenues.

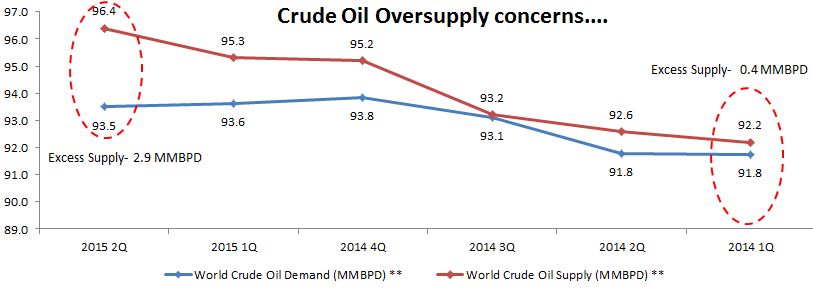

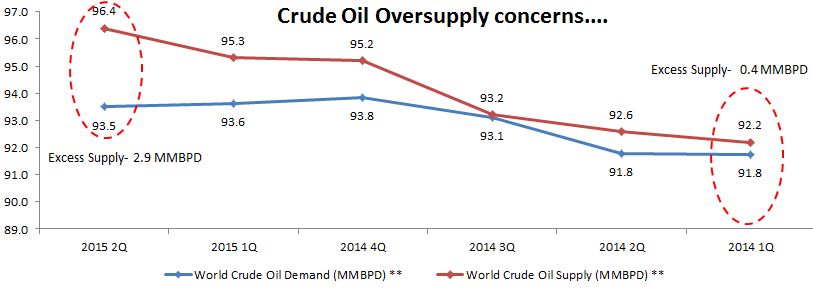

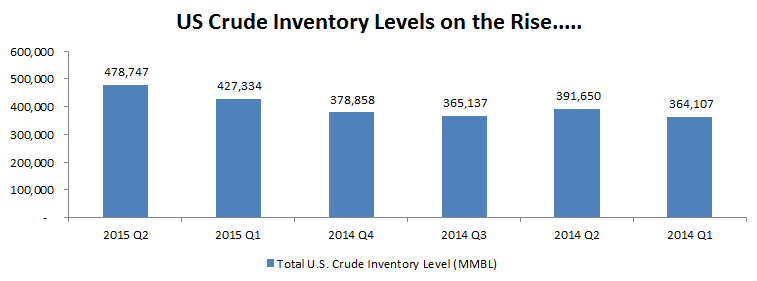

- Based on data from the IEA (International Energy Agency), there has certainly been a case of oversupply which is causing oil prices to decline further. In Q1 2014, the total oil surplus was recorded at 0.4 mmbpd, which has more than tripled in Q2 2015 to 3 mmbpd. This sign of oversupply caused by a slowdown in global consumption is certainly a cause for concern. Inventory levels continue to elevate due to slowdown in demand.

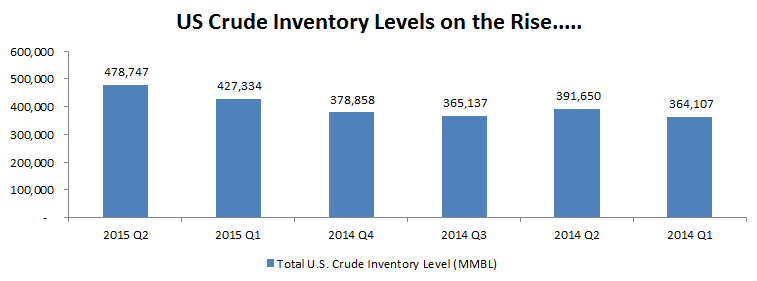

- Rising crude oil inventory levels is a clear leading indicator of economic weakness, and outlines a sluggish consumption sentiment. The record US inventory and rising global inventory will weigh on the crude oil market. There’s speculation of oil producers storing unaccounted oil in the super tankers due to the expectation of a quick reversal of crude oil prices. This will put pressure on the physical oil market.

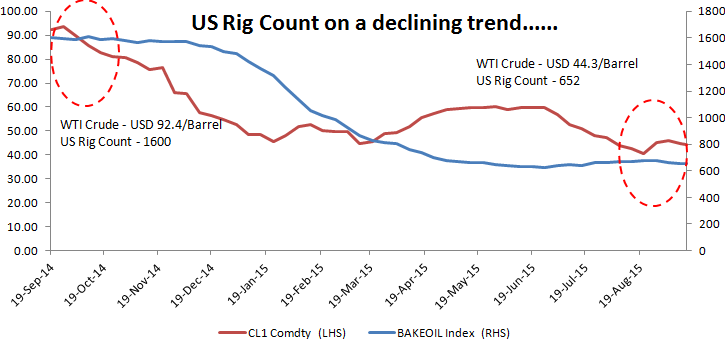

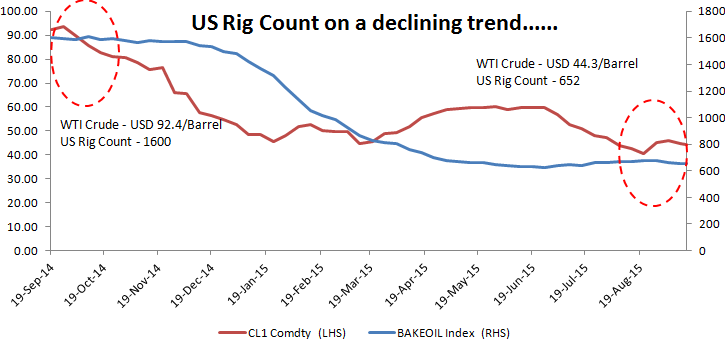

- A falling oil rig count is another indicator, which occurs when rigs have to shut down as the cost of oil extraction can no longer match with revenue from sale of crude oil. Last week, Baker Hughes published its US crude oil rig count report on 11 September 2015. The data showed that US crude oil rigs fell by 10 to 652 for the week ending 11 September 2015. This has more than halved from 1,600 rigs in Sept 2014.

- Over the past weeks, the crude oil rig count rose by 24 despite the volatility in crude oil prices. The roller coaster ride of crude oil and the rig counts imply uncertainty among crude oil producers. The only option left for crude oil producers is to produce more with low-cost wells in order to sustain the market. This will increase production. In contrast, the high-cost wells will be idled. The companies with high debt and operational stress will enter into merger and acquisition activity or shut down.

- The oversupply glut will continue to drive down oil prices to new lows, following OPEC’s decision not to reduce supply. China is one of the major importers of oil, and a slowing Chinese economy will drive down consumption, thereby reducing the price of oil even further.

- Oil exploration companies that invest heavily in technology by taking on debt will face the burden of a potential US interest rate increase by year end, thereby shutting down their operations. The US congressional vote on the Iran nuclear agreement would lift sanctions on Iran, thereby allowing the country to increase supply in the oil market, thus exacerbating the global supply glut. We believe that crude oil is certainly poised for a downtrend until the end of the 2015. Goldman Sachs has forecast crude oil at $20/barrel for FY 2016. However, should the global demand outlook change, we would certainly see a recovery in oil prices.

Source: EIA – Energy Information Administration; Bloomberg.